RICS Surveyors offer a RICS Level 2 Homebuyer survey Report providing you all the information you require on the property your are buying. The RICS Level 2 Homebuyer Report is a popular report and covers all aspects of the property. The report includes information on the construction and the condition of the property and will identify defects, which are deemed to be significant or require urgent work, that affect the property value.

The homebuyer report will assess the open market value, re-build cost, marketability and will provide you with a breakdown of any costs requiring attention. Furthermore the a surveyor will undertake a careful visual inspection of the whole property. The Level 2 Homebuyers Report will note any major problems that might affect the value of the property and may need a specialist inspection before you sign a contract. The Level 2 Homebuyers Report does not include a valuation, though you can request one when you instruct your surveyor. You can also ask your surveyor to focus on specific issues.

Purchasing a property in London is different from anywhere else in the country, freehold or leasehold. Therefore it is really important to know what you are investing in before you part with your money. One vital aspect of your home-buying process is to make sure you instruct a RICS homebuyer survey. Homebuyer surveys in London are virtually essential as these surveys will tell you about the condition of the property, and will also tell you about any urgent repairs that may or may not be needed. They will also point out those typical issues for London.

One of the most common problems from our panel of Chartered Surveyors in London come across when surveying residential London properties is building defects, planning disputes and utilities problems. However, as we shall see today, with only one in five London property buyers bothering to get a Chartered Survey report before purchase, the means of identifying defects in a property before you buy it whether it is listed, in a conservation area or just simply a listed London building, is vastly underutilised.

A Homebuyers Survey for London council properties and flats starts at £700, whereas a typical fee on a 3 bed property is circa £850. The RICS level 2 House Survey would detail such issues as structural movement (subsidence) and damp, drain testing and more severe problems inside and outside the house. You can also request an additional valuation to find out whether the price agreed for the property accurately reflects the price before making a final decision.

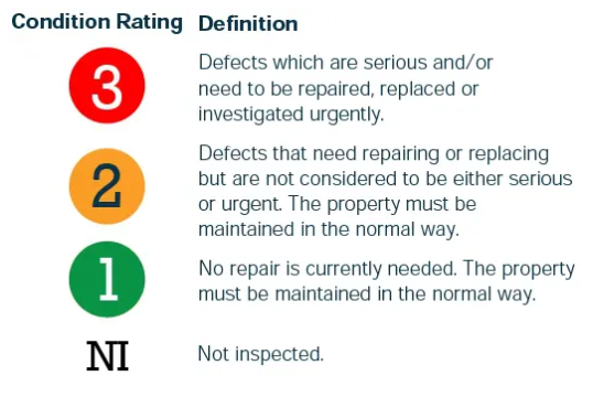

RICS HomeBuyer Report (Level 2) is the most common condition report, costing roughly from around £700 to £1,300. It gives you an overall view of the property’s condition and highlights any problems that might affect the value. RICS HomeBuyer Reports use a traffic light rating system when indicating the severity of property defects and safety issues.

It the building is larger, a “RICS Level 3 Building Survey” may cost you between £800 and £1,500 or more in exceptional cases. Because this survey provides a detailed analysis of defects, it is not the cheapest option (remember, cheap can be expensive). If you are on the top of a hill and with a steep sloping garden, for example, a level 3 RICS building survey is appropriate and will tell you if there is any foundation movement.

We have a panel of well known local RICS surveyors in London and they have a great deal of experience with residential property surveys.

The surveyors offer many different services including a HomeBuyer Survey and Valuation. This is a more detailed inspection of the property and is more aimed at identifying any issues or problems that could have an effect on the value of the property.

Accreditation/qualification: the London Surveyors team is a team of qualified experienced chartered building surveyors who may also be accredited by RICS. The Royal Institution of Chartered Surveyors is the leading, largest, and most influential global professional body in land, real estate, construction and environmental issues with a team of in excess of 200,000 accredited professionals. There are other accreditation bodies our panel of surveyors are with and such membership denotes the highest standards of expertise and integrity in valuation, management and development of land, real estate, construction and infrastructure.

Specialty: our panel of surveyors offer an unfettered opinion on condition and value of property alike. They are more than familiar with the unique considerations and idiosyncrasies of London property on account of many years’ experience in the region. They work to an incredibly high attention to detail. The team’s HomeBuyers survey is incredibly thorough, involving a visual inspection of all accessible areas in the building, and will notify you of any potential problems ranging from subsidence and damp, to timber decay and roof problems. They make sure any nasty or expensive surprises are well and truly avoided after the purchase.

Clarity: after the inspection, the report produced is easy to read, jargon free and comprehensive. The report details any defects found during the survey, gives professional advice on repairs and maintenance and can even be used as a powerful tool to renegotiate the price of your new property.

Post survey support and advice: your surveyor should not just leave you with a report at the end, but also offer post survey consultation where you can discuss the report, the potential implications and receive some advice moving forward to speak to your solicitor about.

Value for Money: a HomeBuyer Report might seem like an extra expense, but it can save you money in the long run. By identifying problems early on, you may be able to negotiate with the seller to carry out repairs or agree a decrease in price to account for the repair work.

In order to make an informed choice on your next home purchase, use reputable surveyors via us to take you through the HomeBuyers Survey process. The London property market is one of the most diverse and fast paced in the UK. As such it is important to have a professional guide you through what can often be an essential process within the faster/higher priced sectors of the market.

These typically average £700. Throughout London, RICS (Royal Institution of Chartered Surveyors) offers buyers various levels of home buyer surveys. The most common levels are RICS Level 2 and RICS Level 3, offering a detailed report that could help you decide if the property you want is worth the asking price.

If you’re looking to buy a new home, whether it be your first home or an addition to your current housing situation, RICS’ London-based team of chartered surveyors can ensure that you get the best service and quality report for you money.

If you are in need of peace of mind and want to guarantee an overall knowledge of what is in store with you potential investments then it is strongly recommended that you take advantage of our unrivalled service, provided by trusted local RICS Chartered Surveyors. Get you free quote today and let us help you find your dream property in London as buying a property in the property boom that is London demands a well-executed Survey. You are however in safe hands here!

When selecting a property, there are lots of things to consider. For this reason getting an RICS HomeBuyer Report can really benefit you.

Overview: the details of what the HomeBuyer report includes and shows you about the property, and has a brief online statement that displays its main objectives. The RICS HomeBuyer report will let you know about any structural problems the property may have, including damp, as well as any repairs or replacements that are needed, from the front gate to the back gate, which could potentially affect you in the future.

‘Traffic light’ ratings: there are three colour coded ratings of the property’s condition which will help you make decisions.

Market Valuation: in addition to the report – you have the option for a market valuation carried out by a RICS registered valuer (at an extra cost, although not as much as it would be for an individual valuation). It assures you paying the right price for the property depending on the properties current status and the local market. These are a must if you are purchasing with marital or legal issues as it will be an accurate assessment available for you in writing how much your home is worth.

Reinstatement Cost Assessment: based on the information you give, our panel of surveyors provide a building cost for the property for insurance purposes (this will be at an additional cost, but will be greatly discounted against a standalone valuation), which is mandatory for ensuring you are fully insured should anything happen.

Identification of risks: you can identify potential legal issues that might force the property value down. This could be very important so you and your client can avoid any hassles or problems later on.

Negotiation: typically, your inspection period allows you to negotiate any outstanding structural, mechanical, pest control or health and safety issues uncovered by the inspection. If the inspection report reveals any serious issues, it could provide you with the negotiation power to re-negotiate the price of the home, the builder offering to fix the items prior to closing, etc.

Peace of Mind: Most importantly, an RICS HomeBuyer Report gives you peace of mind. Knowing the condition of the property you’re about to invest a significant amount of money into is a great stress reducer and pudding avoider. This is also the case for many newly constructed homes.

Mortgage approval: some mortgage lenders require a property survey from a recognized body like RICS before they will approve a mortgage application. The RICS HomeBuyer Report qualifies as a survey for these lenders.

Longer Term Savings: Although there is a charge to get a RICS HomeBuyer Report, this can lead to long term savings to the home owner. By seeking to identify and address any issues upfront can result in savings for the homeowner by avoiding costly expenses during the course of their ownership of the property.

Professionalism: RICS Chartered Surveyors know what to look for when assessing a property, which means they will pick up on any potential problems you may not have noticed. If they spot something that you hadn’t anticipated, it’s an easy way to re-negotiate the price ready for any potential work that needs doing to the property.

So if you get a RICS HomeBuyer Report you can be sure to have all the information you require about a property and this includes knowing the condition and its value as of the date of the inspection, in addition to any potential future problems that might end up affecting the property value or habitability, meaning it is valuable report to have if you are going to buy a house that is of interest to you.

The London property market is exceptionally complicated. Therefore, before making any decisions it is always good practice to gather valuable insight. A RICS homebuyer report, as supplied by your qualified chartered surveyor, will do just this, giving you an authoritative, accurate and up to date perspective on the property, to assist you in making the correct decision for your family and future.

From just £700 you can have the peace of mind of an RICS HomeBuyer Report to help with your financial stability in the future and the comfort and safety of your family. You may also save yourself thousands of pounds off the price of the property. The team of surveyors currently offer two separate residential property survey reports.

The RICS HomeBuyer Report is the most basic of the building surveys. Our panel of surveyors also offer the RICS level 3 Survey and Roof Surveys. You can get a quote on any survey offered for free to determine the proper survey for you at what cost, and you can contact us to find a surveyor who is best for you.

It is worth bearing in mind that even though there is an extra cost associated with higher quality property surveys, it could save you money in the future by flagging up any issues which could need expensive works undertaking later on. So paying for a homebuyer’s survey or a full building survey on a property in London really is money well spent.

Please see the below diagram for an explanation on the traffic light system.